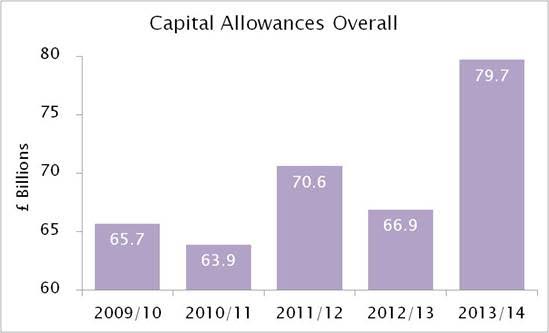

Businesses claimed £79.7 billion in capital allowances for plant and machinery in 2013/14, the highest total since the recession and up by 19% on the £66.9 billion of capital allowances claimed the previous year. However, BNP Paribas Leasing Solutions warns that the rate of investment in new equipment and machinery could start to slow as a key capital allowance is cut back from the end of December.

BNP Paribas Leasing Solutions points out that business investment in new equipment and machinery has been supported in particular by the Annual Investment Allowance, which offers tax relief at 100% on qualifying expenditure in the year of purchase.

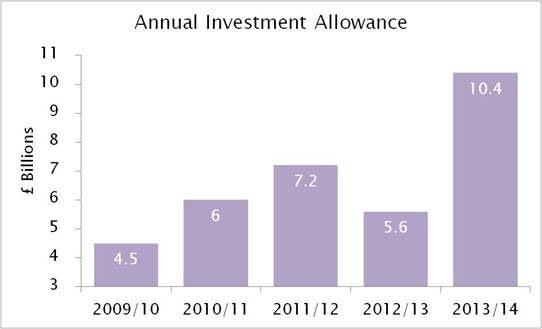

In 2013/14 businesses claimed a record£10.4 billion of tax relief for plant and machinery through the Annual Investment Allowance (AIA). However, the AIA is set to be cut from £500,000 to £200,000 from the end of December.

BNP Paribas Leasing Solutions points out that the AIA has played a crucial role in encouraging businesses to make very significant capital investments. While tax relief is available on capital investment over the AIA limit, the relief is spread over the whole life of the asset rather than being available immediately, making it less valuable to businesses seeking to reduce their short-term tax liability.

Previous reductions in the limit for the AIA have had a major impact on the amount of relief claimed and related investment. BNP Paribas Leasing Solutions points out that after the AIA was cut by 75% from £100,000 to £25,000 for the 2012/13 tax year, the value of relief claimed through the AIA fell by £1.5 billion from £7.2billion to £5.7 billion (a fall of 21%). The total amount claimed in capital allowances for plant and machinery also declined, falling by £3.7 billion from £70.6 billion to £66.9 billion (down 5%).

Comments Tristan Watkins of BNP Paribas Leasing Solutions: “The latest figures on the use of capital allowances show how crucial the Annual Investment Allowance in particular has been in helping businesses to prioritise investment at a time when the economy has been climbing out of the recession.”

“While British businesses have done extremely well on job creation, they have lagged slightly on productivity, which means they could risk falling behind overseas rivals.”

“Any business that needs to make a substantial investment in its machinery or technology to maintain its competitive edge and can benefit from the extra tax allowances currently available should act now, before the Annual Investment Allowance falls at the end of the year.”

Farming sector to be amongst the most affected by fall in Annual Investment Allowance

BNP Paribas Leasing Solutions adds that the farming sector is likely to be amongst the most affected by the fall in the Annual Investment Allowance, due to its reliance on machinery and equipment to maintain productivity, as well as the relatively small average size of businesses across the sector.

Farmers benefitted from a record over £1.1 billion of capital allowances in 2013/14 driven by the increase in the AIA that year. The use of the AIA accounted for half of all capital allowances claimed by farming and agricultural businesses –the highest proportion for any sector

BNP Paribas Leasing Solutions points out that businesses wanting to take full advantage of the current tax benefits available for major capital investments and still keep cash flow healthy can choose Hire Purchase rather than outright purchase. They will be able to claim their full annual Investment Allowance for assets that are in use on their premises by the end of December, without having to have made all the payments associated with the acquisition by that date.