China is emerging as a major pork player on the world’s stage. This is not only due to its already leading position in pork production, but is also increasingly due to its rising influence on global pork markets as fluctuating imports affect global supply and demand balances as well as prices.

If current trends in China’s pork production and industrialisation continue, corn imports could approach 20 million tonnes per year within a five-year time frame, according to a new study from Rabobank Food & Agribusiness Research and Advisory.

This is one of the changes in the landscape of the pork industry that will have major reverberations on world markets.

Value growth will be rapid due to the increasing demand for value-added products, convenience and food safety. In response to market dynamics, China’s pork supply chain is undergoing industrialisation.

A number of factors are driving the development of the pork market. At the downstream end of the pork supply chain, the consumer market is driving the direction of industry development. China’s diet structure has changed greatly over the past few decades as the population is consuming more meat and less grain than in previous years. However, pork’s share of overall meat consumption has decreased sharply while other meats have gained importance. Pork consumption is expected to slow further in the coming years but will retain its dominant position.

As China has no comparative advantage in land-intensive agriculture (e.g. corn), strategically it would make more sense for China to import such products instead of the products for which China has a certain advantage (e.g. pork). Pork production is less land-intensive if middle-sized farms play the dominant role. Therefore, instead of increasing pork imports, China should increase corn and soybean imports to facilitate the rapid domestic industrialisation of hog production.

If current trends in China’s pork production and industrialisation continue, corn imports could approach 20 million tonnes per year within a five-year time frame.

The pace and success of the industrialisation that is rapidly taking place across China’s pork sector will be a major determinant to whether China will move back towards self-sufficiency or become an even bigger importer.

If China could improve its corn yields and swine feed conversions ratios towards US levels then goals of self sufficiency are achievable.

If China does not have to import pork, it will need to import corn, and if current trends in China’s pork production and industrialisation continue, corn imports would rise significantly.

There are a number of factors that impact consumer demand for pork meat. Income growth, population growth and urbanisation are the primary factors driving increased pork demand over the long term. Rabobank forecasts that total meat consumption in China will continue to increase but at a slower rate due to decelerating population growth, which is around 0.5 percent each year. Pork consumption is in line with this trend.

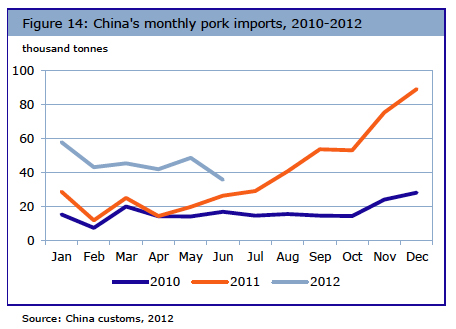

China has recently been importing over 0.4 million tonnes of pork per year, in a world market with trade of less than 7 million tonnes per year. China is likely to continue to be an importer of both pork and corn for the foreseeable future, but how much of each will depend on improvements in the supply chain.

China’s pork supply chain is in transition period, shifting from traditional household farming to modern commercial systems. While both farms and processing plants are growing rapidly in size, co-ordination between the two remains undeveloped. The pork supply chain is still based on the spot market in most cases.

It also has a lack of comparative advantage in land intensive agriculture (e.g for growing corn), so it should import this type of commodity rather than producing, and focus on areas such as pork production. However, challenges in achieving success in pork production include the continuation of disease problems, food safety issues, logistics and the lack of a cold chain.