With the Basic Payment Scheme (BPS) application deadline looming across Scotland and England, and currency markets affecting most sectors, there’s still time for farmers to consider their options for how their BPS payment is received.

This is the message from Andrew Naylor, head of agriculture at Lloyds Bank, who says that whether they’ve already submitted their BPS application form or not, farmers can still change their choice of currency in which to receive payment – Sterling (£) or Euros (€) – by notifying the RPA in writing by the deadline on 15 June 2015.

However, he warns they should tread carefully as the past few years have illustrated the degree to which exchange rates can fluctuate.

“Choosing to receive your payment in Sterling means accepting the applicable EUR/GBP exchange rate,” explains Andrew. “A change this year is that the exchange rate used will be an average of the European Central Bank rates during September in the scheme year.

“So if the Euro weakens against Sterling between now and then, the payment ultimately received in Sterling could be considerably lower than if it were to be converted at today’s EUR/GBP exchange rate.”

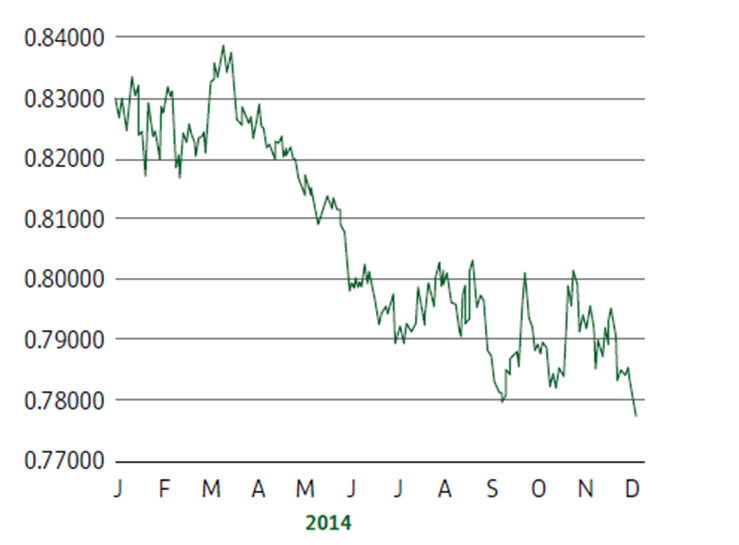

He says the impact of the fluctuating rates can be minimised through hedging, as illustrated using 2014 exchange rates (see graph). “Had a BPS payment of €50,000 been hedged in March 2014 to mitigate a change in exchange rates, it would have resulted in a Sterling payment of £41,585 at the average exchange rate at the time of 0.83170,” explains Mr Naylor.

“But had this amount not been hedged, the Sterling payment would have been £39,528.50 based on the prevailing exchange rate of 0.79057 in September 2014.”

However, he says hedging is not the only way farmers can exert a degree of control over the eventual amount of BPS payment received: some could choose to receive the payment in Euros rather than Sterling.

“However, this requires an ability to hold off on using the money until the exchange rate is favourable to convert back to Sterling,” says Mr Naylor. “Pressing payments or capital needs can sometimes take the timing decision out of your hands.”

While it is not possible to predict future exchange rates, 2015 has already seen increased levels of volatility in the currency markets. A number of factors such as the decision of the Swiss National Bank to end its cap, uncertainty surrounding the Greek election and the Eurozone in general, and the decision of the European Central Bank to begin Quantitative Easing, will continue to create volatility.