The minutes of the US Federal Open Market Committee (FOMC) showed that several members were no longer in favour of QE. This committee makes the key decisions about interest rates, exchange rates and the US money supply. This came as a surprise to most analysts who view it as a forthcoming policy change.

The markets take the view that QE supports the commodity markets, and therefore a signal has been made that although QE will continue in the short term ($1tn of QE is expected in 2013), that this might be the time to switch bets from commodities to other asset classes such as equities.

In support of this: the US’s largest public pension fund (California Public Employees Retirement fund) announced last week that it had reduced its exposure to commodity futures and options from $3.45bn to $1.56bn; the CTFC report that at the end of the year the non-commercials held the smallest net long of soya since mid-February, and had greatly reduced their exposure to maize and wheat; the FTSE100 broke through 6000 for the first time since July 2011. The crystal ball-gazers forecast that the FTSE100 will hit somewhere between 6,500 and 7,000 at the end of this year.

Although the short-term market trend in the EU wheat market has been down, the long-term direction is difficult to determine. UK wheat normally follows US maize, but recently it has been following French wheat because we have been importing so much from the EU, so-called import parity.

French milling wheat (May) broke down through the €240/t barrier this week - which it has not breeched since July last year. Logically prices should continue to fall in the short term until buying starts in earnest, or until there is concern about the weather and crop condition. The eagerly anticipated USDA report is due out today (11th Jan) at 5pm, too late for us and the market to digest, so we will comment next week. Most countries have decent stocks of wheat, but some Middle Eastern countries have seen the recent falls as a buying opportunity.

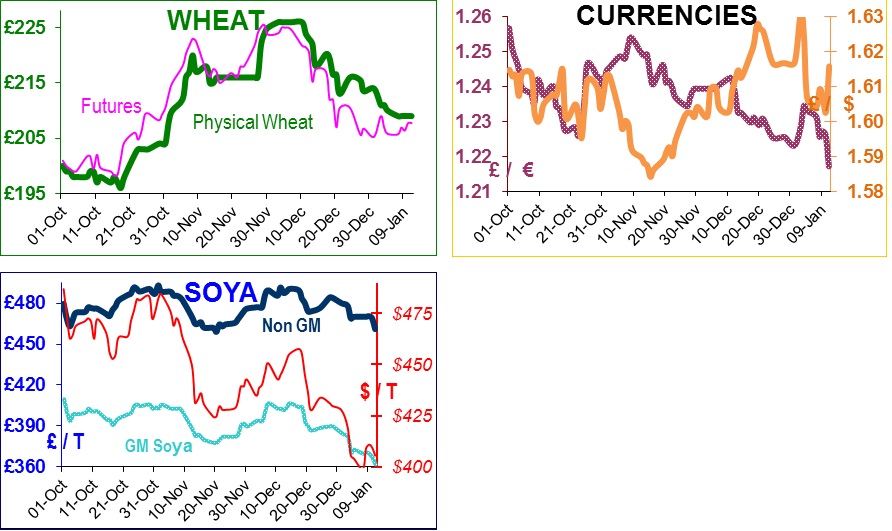

If our maths is correct, on Monday US wheat was trading at the equivalent of £172/t versus EU wheat at £204/t, and is the world’s cheapest seller. The US is still waiting for wheat orders. May futures wheat has been trading at around £208 this week, and GM soya at around £362 ex port.

It would seem all the banks are long of wheat. Commerzbank believes ‘the latest fall in prices to be exaggerated, as the supply risks … are largely being ignored’ and point out that China has had the coldest winter for 28 years so there are concerns about winterkill to their wheat crop. [Apparently it is so cold that there are reports of 1000 ships trapped by over 300 square kilometres ice in coastal areas].

The Commonwealth Bank of Australia said that the recent price falls were ‘unwarranted’. Society Generale approach expressed caution against the optimism about US maize and soya crops due to the lingering effects of the drought.