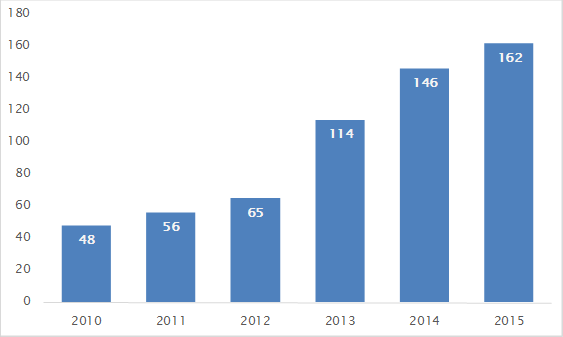

162 food production companies entered insolvency last year, more than treble the 48 insolvencies in the sector in 2010 and 11% more than just a year ago, new research shows.

Accountancy firm Moore Stephens says that food suppliers are still bearing the brunt of the on-going supermarket ‘price war’ as their profit margins are squeezed by big supermarket chains trying to offer consumers the lowest prices possible whilst maintaining their own profit margins.

Moore Stephens explains that the expansion of budget retailers in the UK market over the last five years has put traditional supermarkets under even more pressure to cut prices in order to compete and survive.

Earlier this year both Lidl and Aldi have revealed plans to expand their presence in the UK, forcing domestic supermarket groups to find extra savings in their supply chains in order to compete more closely with the discounters.

However, the research explains that this inevitably causes the other major supermarkets to ask their food producers to lower their prices.

Duncan Swift, Partner and Head of Food Advisory at Moore Stephens, comments: "The extreme buying and retail pricing strategies of big retailers mean smaller food producers are struggling to stay afloat.

"Food supplier insolvencies are still rising as small producers continue to be the major casualties in the supermarket price war.

"With no end to the price war in sight, food manufacturers are finding themselves less and less able to subsidise the aggressive buying tactics of big retailers.

"It’s not just the pressure on the headline supply price itself, there are concerns about when that price will be paid as 120-day credit terms are commonplace.

"Supermarkets also demand unilateral deductions from prices for a company to remain on their suppliers list.

"With the likes of Aldi and Lidl announcing further plans for expansion, competition between budget and traditional supermarkets is only going to heat up.

"Just this month, Sainsbury’s has announced the results of a major review of its price discounting policies.

"Smaller, regional food producers often rely on one of the big chains as their main route to market.

"This often means their negotiating power is weak when it comes to the pricing and payment terms for their products, and many are going out of business as a result.

"With over 70% of what UK food suppliers produce going across the buying desks of the UK’s top 10 supermarkets, the buyer power of supermarkets remains enormous.

"There are ways and means to mitigate destructive buyer power but all too often suppliers don’t prepare themselves early enough to survive the onslaught.

"The Groceries Code Adjudicator recently issued its first censure of a supermarket for its treatment of suppliers, particularly regarding late payment and unilateral back-margin deductions – a long anticipated move.

"However, as these unreasonable behaviours are prevalent throughout the supermarket sector, for the regulator to begin to positively change these behaviours it needs to be prepared to show its teeth more often."