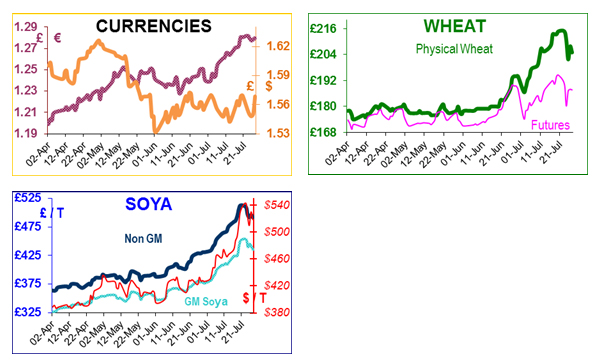

Last Friday, Nov wheat futures were just shy of £195/t, on Monday prices fell to £190, on Tuesday prices crashed momentarily touching £177.50 before recovering to £187.25 on Wednesday.

Why? It appears that a thunderstorm over the traders pit in Chicago following months of heatwave was partly responsible.

Their relief at seeing rain translated itself into euphoria that (possibly) the maize crop was saved, then reality dawned. It would also appear that a virtual ‘fat finger’ from a ‘black box trading system’ [buy wheat, sell maize] was also partly responsible for the plunge. Similarly November soya beans were trading at $16.90/b last Friday; then plummeted to $15.52/b on Tuesday.

The US has the worst drought since 1956. Cereal substitution will be required by countries worldwide, and higher prices will make it worthwhile for countries to import from unusual sources ie USA imports South American maize, Vietnam imports Indian maize, China buys Ukrainian maize.

In the US high feed prices mean that livestock producers are using lower protein diets and selling at lighter weights, whilst economists talk of ‘demand destruction’ and point to closing bioethanol plants and livestock farms.

A frenzy of analysts are forecasting the top of the market at around $9-10/b (now $8.9) for wheat, $8-10 (now $7.8) for maize and $18-20/b (now $16.7) for soya. Morgan Stanley predicted an average 2012-13 wheat price at $8.20/b, maize at $7.85/b, and soya bean at $16.00/b. It is generally believed that rainfall now would be too late to save the maize crop, but would save the soya as it would be in time for the vital pod-setting stage.

The Black Sea is not trouble-free either. The IGC believe that Russia’s exports may fall by 40-50% due to drought, as its wheat crop falls to around 40-50mt (56mt last year). Kazakhstan promises no export ban despite a crop forecast at 50% of last year at 14mt grain (27mt last year). Kyrgyzstan estimates that it will lose about 50% of its grain crop, and may need to import 1mt of grain from Kazakhstan and Russia.

On the basis that the CIS states will look after each other first, there is a question mark over Black Sea exports this year. There are already reports that some Black Sea exporters are defaulting on contracts. Romania believes that it has lost 20% of its wheat crop and up to 50% of its maize. The Indian monsoon rains are 22% below average, and drought may be declared without better conditions soon. The NOAA has raised the probability of an El Nino event from 50% to 65%, which is characterised by a dry Australia and a wet South America. Western Australia is dry and rain is needed now for the wheat crop; the next disaster waiting in the wings?

The IGC forecast world wheat production (2012/13) at 665mt (696mt last year), putting world wheat stocks at 183mt - a 4 year low; maize production was cut by 53mt due the US drought to 864mt giving a world carry out of 115mt – the lowest for 6 years. They also cut the US soya crop by 8mt to 79mt (83mt last year), but predict a 9% increase in world soya bean production due to increased plantings in South America. So short term (to Spring) we are going to be short of soya; long term cereal supplies will be tighter than usual.