With inflation running at 20%, Argentinean farmers are reluctant to sell the only asset that is retaining its value – $-based soya beans! They are still clinging onto 3mt of old crop, have only sold 12% of new crop (total harvest estimated to be 50mt) when they normally would have sold half by now.

The government has imposed strict currency exchange rate controls (5 pesos/$1), which means that a black market has developed for cash (8 pesos/$1).

But soya can only be exported at official exchange rates which are 35% below black market rates, which when added to a 35% export tax, it is not surprising that export sales have dried up. The resultant lack of export tax means the Argentinean balance of payments is not improving; there are rumours that the government could force farmers to sell soya.

In Brazil there are rumours of a strike against the government decision to privatise the running of some 160 loading terminals, which threatens the workforce in terms of staffing and benefits. The Brazilian harvest is about 20% complete, as rain is said to have delayed harvest. Apparently the queue of 142 waiting ships is now 30-40 days long, with a combined total of 11mt of capacity waiting to be filled.

In the US, last years’ drought is not over, as the soil is still too dry in the run up to planting. Dedicated pessimists are already calculating the possible effects of a second-in-a-row US crop failure, and firing the first shots in the food or fuel debate. Optimists point to the widespread snow and rains expected over the next week.

China has allegedly bought as much as 1mt of wheat from the US, Canada and Australia in the past two weeks. Egypt bought 60,000t wheat from the US this week – nothing extraordinary except that no-one in the EU, Black Sea or Australia made any offers, which tends to confirm that exportable supplies are becoming exhausted, and that the US may be the last wheat exporter left standing with wheat that is €10/t cheaper than the EU (delivered EU!).

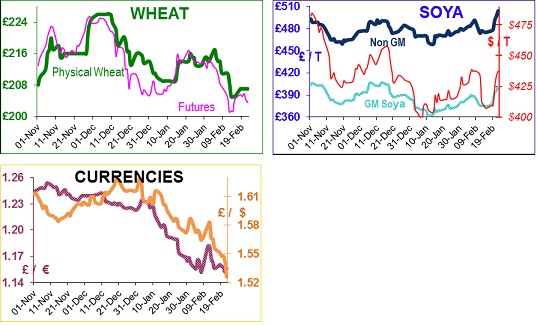

The USDA’s annual conference, Outlook Forum, is held this week; they forecast 30% lower average prices for maize and soya at $4.80/b and $10.50/b respectively for 2013-14, because of record harvests in both crops. UK May wheat futures are about £207, GM soya is about £400 ex port; currency is a major factor in supporting prices.

The FT recently reported that the average commodity hedge fund lost 3.7% in 2012. Last year three of the biggest commodity hedge funds closed, one of which (Fortress) lost 13% in the year to May 2012. The current two-largest funds, Clive Capital (London) and Blenheim (Australia), have lost money for two years running; Clive Capital managed a fund of £3bn in 2011, had lost almost £2bn by the end of 2012; Blenheim lost about $2 billion.

Calpers, the California pension fund, reduced its commodity holdings by half in October 2012, having lost about 8%/annum for five years. Barclays has also withdrawn from speculative bets in agricultural commodities. It seems that some of the larger players have permanently withdrawn from our markets (hooray!), and it is possible that prices may assume less stratospheric levels with less volatility (we can only hope). Of the more successful funds, the $600 million (£392m) Black River Commodity Trading fund run by Cargill, specialising in agriculture and energy, gained almost 9% last year.