Investors target English farmland as prices double in five years

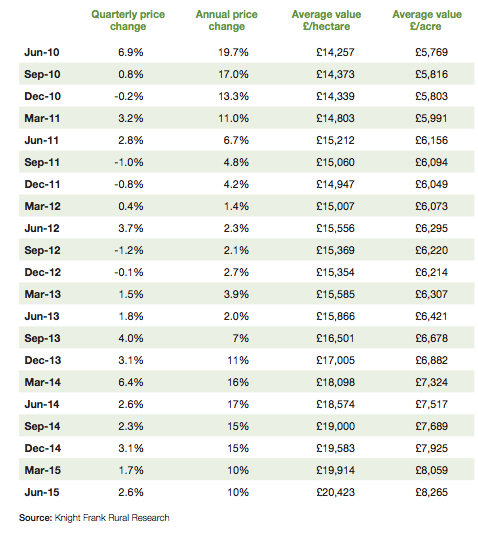

The average value of English farmland has doubled over the past five years to about £8,300/acre, according to the Knight Frank Farmland Index.

The past five years have seen the performance of farmland continue on the same trajectory that it has been following since 2008, offering better returns than London property or the FTSE 100.

However, the market is becoming increasingly complex in terms of valuing specific blocks of land with price variations growing at both the national and local level.

"For the first time that I can remember, large blocks of farmland have frequently attracted more interest and made more money when sold separately from the core of an estate rather than together," said Clive Hopkins, Head of Farms and Estates at Knight Frank.

The sluggish recovery of the prime country house market from the global financial crisis is also contributing to the trend."

So what has been driving the growth in farmland values? The link between commodity prices and land prices has been tenuous to say the least over the past five years.

A slight increase in the amount of land for sale, combined with lower agricultural commodity prices, means potential buyers are becoming more cautious and price sensitive when choosing what to bid on.

Land quality is once again a serious consideration and vendors should be realistic when setting guide prices as over-priced farms will struggle.

"But availability is still historically low, and as a consequence we are seeing buyers, particularly investors, looking further afield, including the Welsh borders and north of England, for larger blocks of good quality land that is priced below the levels being achieved in parts of East Anglia and central and southern England," said Knight Frank.

"There is also still a significant number of farmers with development roll-over cash to reinvest into land and this is helping to create local hotspots.

"The wide variation in prices makes it extremely difficult to predict where the market is heading, but a period of flatter price growth while the market consolidates is likely, although premium prices will still be paid where there is competitive bidding."

In a recent sale for example two people, one a farmer with development proceeds to rollover, the other a neighbouring landowner, were bidding on a 270-acre block of land in Warwickshire and this pushed the value up to £12,000/acre.

I think this trend is only likely to continue. While overall the market will remain firm, some sales will surprise, while others may disappoint. Sensible pricing and careful marketing will be key to avoid the latter.

While the average value of English farmland has increased by 43% over the past five years, the market for larger blocks of good quality land of interest to investors has shown even stronger growth.

The demand has come from investors, ranging from private wealthy individuals to pension funds.

The index, which measures the change in the value of blocks of land over 1,000 acres in size, has risen by 100% over the past five years. The average price of investment grade land is now £12,500/acre, although deals have been done at significantly higher levels.