It is fair to say that that the commodity trade is baffled, bewildered and bemused. Every fundamental indicator points to a global scarcity of cereals and proteins.

There is virtually no carry-in stock from last year, therefore rationing has to take place. So prices, even at these dizzy heights, should be going up to ration demand, and the economists suggest that livestock farmers worldwide will be the major casualty because the bioethanol boys have deeper pockets. Instead prices have been coming down until the last two days. Why? Does the world believe that the US has more maize and soya despite all the drought horror stories? Does it believe that everyone will be saved by massive Brazilian crops?

Brazil is struggling to fill boats with its current 66mt soya crop; and one of our suppliers has had a boat waiting to be loaded for two months, can you imagine how it will cope with next year’s estimate of 81mt?

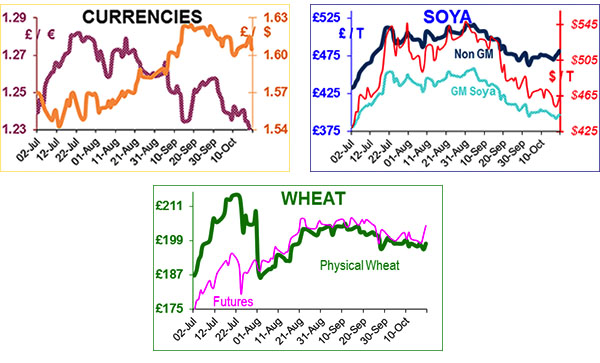

Apparently the reason for the soya decline appear to be better rain in South America (for soya planting); the maize decline appears to be linked to the fact that Brazil is selling its maize at $55/t below the US and demand destruction – US cattle farmers are losing $300/head and some bioethanol plants have been mothballed.

There are also discussions in the US that the forthcoming US election (Nov 6th) or the new Frank Dodds Act which limits fund speculation (Jan 2013) are making investors cautious, so they are exiting agricultural positions en masse. There is also a ‘disconnect’ between fund traders who bet on screen movements, and the agricultural trade who depend on wheat and soya for a living.

So we believe that this could be an opportunity to buy commodities forward – we are not saying this is the bottom – but that against the fundamentals of the next six months’ supply and demand, prices appear to be good value. Please read the disclaimer below carefully.

At the FAO meeting in Rome, EU Farm Ministers agreed that less volatility in food commodity markets would be ‘a good thing’. They could not agree ‘how’, and struggled with the concept of strategic grain stocks, and skirted around biofuels.

It is mid-October and all we hear is the ‘wailing and gnashing of teeth’ from the UK grain trade. Every farm has to be visited to determine what quality wheat they own; normally a job given to students, but the harvest was so late that the kids had to go back to school.

So the executives had to borrow the run-down car pool car to visit farms (taking their own 4x4’s would be a red rag to a bull).

On the last day of September the trade could only give us 29t of 68+ bushel to collect for October, even though we had more than 10,000t of wheat purchased for this quarter, because they are not coping with this situation. November is the busiest month simply because it is easily hedged with futures, but the feed trade have already bought, so the grain trade are ‘stuffed to the gunwales’ – with much of it below 65 bushel, and therefore unfit for (our) purpose.

A few boats would ease the congestion, but with poor quality and high prices that is unlikely.

Consequently there are lots of spot sellers but no buyers, and lots of buyers for Q1 next year but no sellers; spot wheat has lifted towards the end of the week to about £200 delivered to the mill following the anticipated news from the Ukraine that they would be banning any wheat exports after 15-11-12. This could firm cereal markets. AO soya is about £389 on the same basis. Non-GM soya is not freely available so difficult to price.

This Commodity Report is distributed by Humphrey Feeds Ltd and is provided for information purposes only. While all reasonable care has been taken to ensure that the information contained is true and not misleading at the time of publication, we make no representation as to its accuracy or completeness and it should not be relied upon as such. This report is prepared for the information of BFREPA members who are expected to make their purchasing decisions from a variety of sources without reliance on this report. Neither Humphrey Feeds Ltd nor its officers accepts any liability whatsoever for any direct and consequential profit or loss arising from use of this report or its contents. This report may not be reproduced, distributed or published by any recipient for any purpose without the prior express consent of Humphrey Feeds.