Lower demand for UK cereals for H&I and animal feed usage, combined with higher supplies contributed to heavier 2015/16 balance sheets than earlier forecast by Defra. Unless a substantial uplift in exports for both wheat and barley occurs, carryover stock levels look set to rise.

The latest update of Defra’s UK cereals balance sheets were published on Wednesday 24 February – click here to view in full. These took account of official usage data for the first half of the season, as well as updated industry intelligence regarding the outlook for the remainder of 2015/16.

Also incorporated into the balance sheets are the final estimates from Defra’s Crop Production Survey, which was published in December. The final survey results provided uplifts to wheat (273Kt), barley (94Kt) and oats (20Kt) production, compared with the figures included in the November balance sheet.

Wheat exports key to avoid hefty carry over

While total availability of wheat is forecast to increase by 2% this season to 20.1Mt, domestic consumption is expected to decline by 4% on the year to 14.7Mt.

Breaking it down, human and industrial (H&I) usage is forecast to decline by 7% year on year (yoy) to 7.27Mt. Flour millers have had a quiet start to the season. Wheat used for milling (as well as starch and bioethanol production) from July-December 2015 was 8% less than the same point last season. Furthermore, demand is expected to remain flat for the remainder of the season. While wheat used by brewers, maltsters and distillers in the first six months of the season was down considerably year on year (-20%), an uplift is expected in second half of the season as some temporary reductions in capacity come to an end.

Animal feed demand is also forecast to decline on the year, albeit by a lesser amount (-1%), to 7.02Mt. The first six month’s usage data did not reflect as high wheat usage as was earlier anticipated. Furthermore, the mild weather experienced so far this winter combined with good forage quality and availability has meant that both cattle and sheep have needed less substitute feeding this season compared to last.

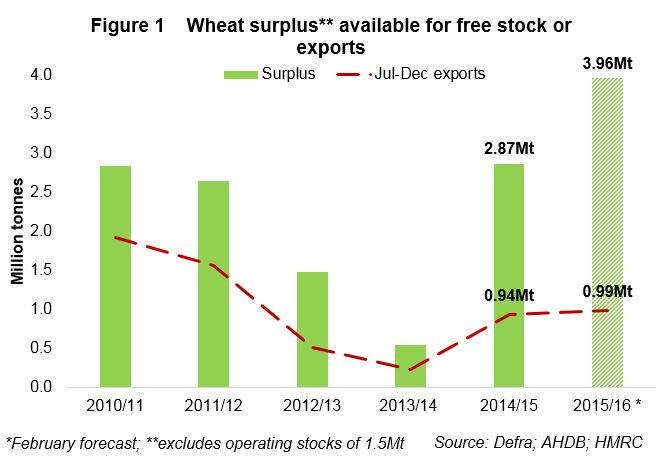

Season to date exports are at similar levels to last year at 0.99Mt (0.94Mt, Jul-Dec 2014). Nevertheless, due to higher total availability and a reduction in domestic demand, the surplus available for export or carry over into next season is currently estimated 38% higher than last season at 3.96Mt (Figure 1). Taking account of UK exports so far (July – December), it leaves a surplus of 2.98Mt to either be carried into 2016/17 or to be exported from January to June.

At the same point in 2014/15, there was 1.93Mt left to export or carry over (excluding minimum operating stock requirement). Therefore, exports for the remainder of the season (January-June) will need to far exceed the pace of the same period in 2014/15 to prevent the carryover getting any heavier.

Barley usage by maltsters takes a hit in first half of season

Human demand for barley originates mainly from the brewing, malting and distilling industries. For the first half of this season, malting demand for barley was down 7% compared with the same period in 2014/15. Demand has taken a hit due to planned temporary closures, but it’s not expected that usage in the second half of the season will make up those losses, as the industry also faces a general downturn in demand. Additionally, the good spirit yields and acceptability levels of the last two year’s crops, means relatively less barley has been required by processers.

Animal feed demand makes up the biggest share of domestic barley usage. At the beginning of this season, barley was included in feed rations at relatively high levels, but this was expected to be short-lived, with stronger exports anticipated. However, cereals usage data for the first six months of the season revealed that barley remained in feed diets at higher levels than anticipated.

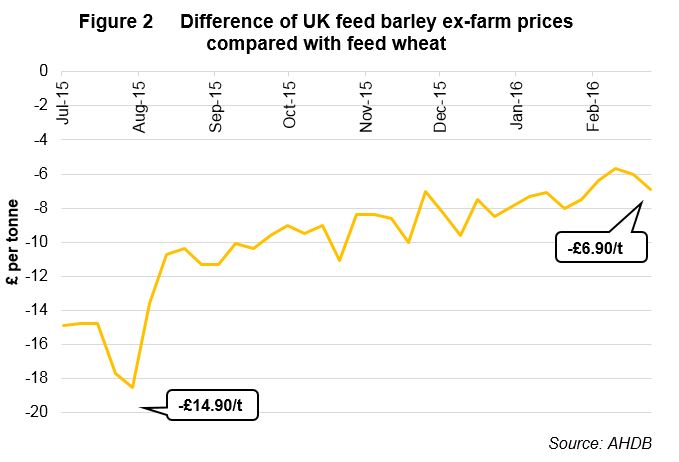

Barley inclusions in animal feed are expected to increase by 1% on the year as the current pace of barley usage in animal feed is expected to remain at similar levels for the rest of the season. However, the price relationship of feed barley compared with feed wheat has a huge bearing on the proportions of barley used in feed. Many feed processors have indicated that when barley’s discount closes in on £5/t, barley inclusions will be kept at a minimum, due to the lower nutritional value of the grain compared with wheat. Keeping a close eye on this price relationship provides a good indication of the attractiveness of barley in feed diets and will be one to watch over the coming months. Figure 2 below reveals that the gap between UK feed barley and feed wheat ex-farm prices has reduced from around £15/t at the start of the season, to around £7/t now.

Higher supplies, as well as reduced demand, takes the barley surplus available for either export or free stock to 2.816Mt. This is up 69Kt compared with November’s estimates and 28% higher year on year.

Maize imports expected at four year low

Between July and December 2015, 0.97Mt of maize was imported, the second highest volume for this point in the season behind 2013/14.

Despite these high imports, the volume of maize used by GB animal feed compounders in the first six months of the season recorded a 2% reduction. Similarly, 29% less maize was used by Integrated Poultry Units (IPU) this season by the end of December. However, animal feed compounders in Northern Ireland have kept maize in the rations at similar levels to a year ago.

The current price relationship between imported maize and ex-farm UK feed wheat suggests that maize is not economical to be used in big volumes in GB. For instance, imported maize (any origin) is £24/t more expensive than UK ex-farm feed wheat (end-Feb). However, the price gap narrows for NI consumers and when logistical costs are taken account of the disincentive to use maize diminishes.

Based on industry information, the pace of maize imports is expected to slow in the second half of the season. Nevertheless, taking account of the strength of maize imports during the first half of the season, the forecast for total season maize imports has been lifted to 1.55Mt, from 1.32Mt in November. While higher than earlier forecast, if realised, this would be the lowest volume of maize imports in four years.

Oat millers’ usage to reach record high

Unlike wheat, barley and maize, the demand for H&I consumption of oats is forecast to increase on the year, by 5% to a record 525Kt. From July to December usage by oat millers was very strong and even more than first anticipated (518Kt forecast in November) and this pace is expected to remain throughout the rest of the season.

In contrast, demand from the animal feed sector is expected to decrease by 25% year on year and is forecast below the 5 year average (Figure 4). In 2014, a high availability of oats within the UK plus prices being competitive against other cereals, meant usage of the grain was quite high as feed. However, the combination of a reduction in production this season, relatively good crop quality and in increase in demand for H&I usage, means there has been less oats available for feed.

Concluding comments

The latest update of Defra’s cereals balance sheets reveal a heavier UK market situation than forecast in November. Lower H&I usage and animal feed demand, combined with bigger supplies contributed to growing surpluses. A strong export pace for wheat and barley in the second half of the season will be key to diminishing the surpluses available.

Key points

• The total UK cereals surplus available for either export or free stock increased compared with November’s estimates, to 7.242Mt.

• Lower demand for H&I usage is evident for wheat, barley and maize

• Oat millers demand of oats expected to reach a record high in 2015/16