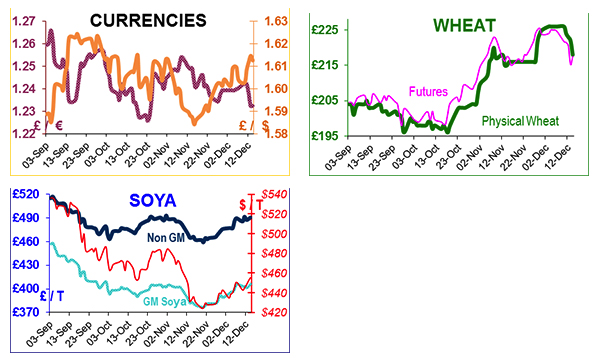

Last Friday UK May futures closed at £227.50, Monday £225.70, Tuesday £224, Wednesday £223, Thursday £217.75. Wow! A £10/t drop over the week! That is all very well, but no farmer wants to sell, so prices lifted and closed at £ 219.50 on Friday.

One of the major soya importers into the UK raised a white flag last week with regards to Non-GM soya. It has reviewed its operations in Brazil (the main source of Non-GM soya) and believes that its Non-GM soya supply line will not be secure from April 2013. As this company supplies about 65% of all the Non-GM to the UK, its signal is significant.

The Brazilian soya crop is expected to be 82mt (65mt last year), an increase of 25% over last year; and most of the extra 17mt is GM. However this creates several problems: the tonnage of GM now swamps Non-GM so the cross-contamination risk is much greater; the export facilities have not increased in proportion to the crop; In world market terms, the UK’s Non-GM is a niche market and segregation effectively blocks and compromises the optimum running capacities of crushing plants and ship-loading facilities. The queues of ships off Brazil in the spring are expected to be humungous, with waiting times measured in months and demurrage costs in $millions.

This puts the retailers in a difficult position with consumers. The ‘soft & cuddly’ route would have been to move from Non-GM to sustainable soya (RTRS or similar).

The problem is that there is not enough sustainable soya to supply the UK. An additional difficulty is that the Dutch have signed up to RTRS starting now until 100% compliance in 2015, so they have contracted to buy 280,000t and some 120,000t of ‘in conversion’ RTRS soya; in other words they have cornered the world’s supply of RTRS. Soya is an essential ingredient in monogastric animal feeds; substitution with peas or beans etc only adds inefficiency and compromises nutrition, performance and GHG emissions etc.

Until we have a (GM) variety of soya that grows in the UK climate, we are dependent on imported soya. GM soya is currently about £397 ex port; Non-GM is not available in the south of England. The USDA reduced the US soya ending stocks to 130mb, the lowest for 9 years, and the lowest stocks to use ratio for 35 years. The world needs perfect growing conditions in South America before a reduction of soya prices can be expected.

Strategie Grains believes that EU wheat exports (2012/13) will be higher (by 0.7mt) at 18.8mt due to exports that have already occurred and by comparative forecasts of various export prices which indicates that the EU is very competitive.

In particular Argentine wheat is not currently competitive which bars it from exporting to North Africa and the Middle East; so the US and French are expected to supply these markets. Argentina has harvested about 25% of its wheat, but the first dust bowl in 85 years, will limit yields to well below 10mt. Apparently it rains on the coast, but the rain clouds cannot reach the interior so there is a dust bowl in the pampas 400km from the coast.

The UK is expected to import in excess of 2mt of EU wheat this year, and it is reported that one of the UK biofuel plants is importing maize to mix with our low bushel wheat. Germany appears to be supplying milling wheat to UK flour mills at such a rate that its own balance sheet, as well as EU grain stocks, now look tight for the end of the season. The USDA lifted Chinese maize production by 8mt, and their wheat by 2.6mt.

Argentinean farmers are still not selling soya, so importers are struggling; apparently farmers are disenchanted with inflation, currency, interest rates, the weather and the government. In the first 11 months of this year China imported 52.5mt of soya (47.1mt same period last year).