The penny is starting to drop. Analysts are starting to get worried. Global maize production is expected to be 849mt and usage is 853mt.

Since the year 2000, world usage has exceeded production in nine of those thirteen years. Biofuels and China are largely the reason for increasing usage, with US biofuels consuming 40% of the US maize crop (in a normal year), and China now consuming twice as much meat as the US, and about 25% of all the meat produced.

Global ending stocks of maize are forecast to be 50 days of usage-the lowest since 1974 when the US instigated export controls on grains and intervened to control the price of foodstuffs. US ending stock days of use in the three years 2009/10 to 2011/12 have been 48, 32 and 29 days respectively, next year the stock days is expected to fall to 20 days - the equivalent of only having enough grain in the system for one working months’ production, so if one biofuel plant has two months stock, its next door neighbour might have run out.

As previously reported, grain exports from the Black Sea are grinding to a halt, and the Ukraine has announced a wheat export ban from the 15th November.

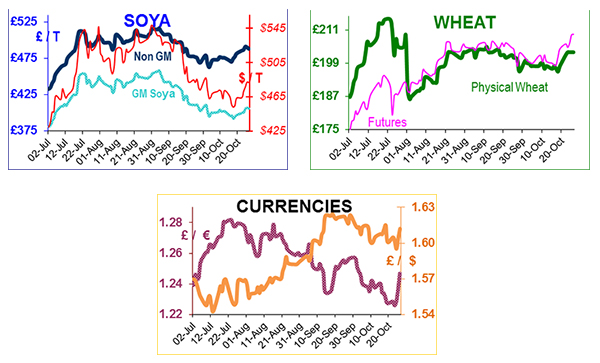

The US is one of the few countries that have surplus wheat to export, mainly because it has been too expensive to date. There are questions about China’s wheat crop this year, as it has recently imported 300,000t of Canadian milling wheat; or possibly it is just stock-piling because the four major non-US exporters (Argentina, Australia, Canada and the EU) have the lowest combined ending stocks for 15 years? So UK May futures have jumped about £10/t in the past 6 working days, and currently £215.

China imported 58mt of soya this year, and that is expected to increase to 61mt next year; which supplements the 12.5mt of its domestically-grown soya. From January to September 2012 it imported 44mt of soya (18% up on last year), 4mt of maize (550% up), and 3mt of wheat (230% up). China is hungry.

As a result, the US has soya export commitments 37% higher than last year, so rationing is required; will South America be able to produce the massive soya crop required and be able to export it? The US hopes to produce 94mt soya next year, Brazil 80mt and Argentina 56mt; if all happens according to the game-plan, then job done! A realist would say it depends on the weather, and a cynic would say that: Christina will tax it; the strikers will disrupt supplies; and the logistics will be near-insurmountable. Place your bets please.

Brazil has planted 16% of its soya crop to date, but dryness has delayed the early crop in Mato Grosso at 26% planted rather than the normal 40%. However it is wetter in Argentina.

US consumers deprived of cheap Brazil maize are being forced to buy the more expensive domestic maize. Strategie Grains added fuel to the fire by reducing the EU maize crop by about 1mt to 52.8mt (USDA estimate 55.6mt). So now we have two bullish geographical areas - the US and EU.

The US harvest is progressing well with 80% of the soya in the barn, and almost 90% of the maize. Over 80% of the winter wheat is planted, unlike the UK which is struggling with wet land. UK spot wheat is about £200/t delivered, November 2013 wheat is firming, AO soya is about £402, Non-GM is not for sale.

Livestock producers around the world are getting squeezed: Russia is supporting its animal feed manufacturers; Belarus is providing its feed industry with state funds; EU is supporting Moldova producers because of its drought; the Latvian Association of Pig Producers is requesting aid from its Min of Ag otherwise they will cease production; India’s poultry farmers are starting to use more risky raw materials (groundnut etc) to substitute for soya; Canadian pig farmers have requested £82-95m in government loan subsidies to survive; and the US Dept of Ag is looking to support all ag businesses hit by drought. As the economists predicted, demand rationing by global reduction of livestock numbers is starting to happen. Batten down the hatches. We appreciate that we are all in this together, and that we will continue to minimise the feed costs as much as we can without compromising performance.