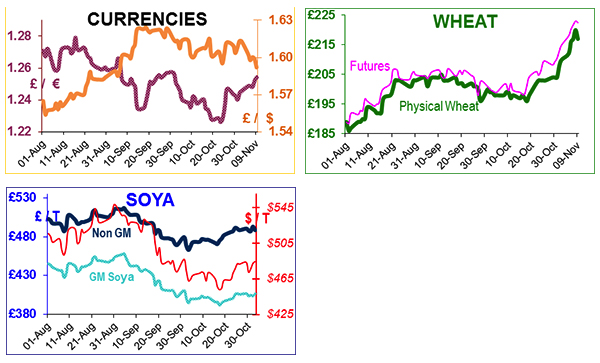

UK wheat prices pushed contract high even higher throughout this week as May futures blasted through the previous psychological record of £222/t (22 Apr 2011) hitting £229/t at one point.

Although the UK has unique problems this year with high prices, low bushel and almost no exports, we are not alone as the French hit contract highs too on concerns about tight global supply, the US Election and todays USDA report. Fund positioning ahead of these events was significant.

The USDA report was bearish on all Ag. Commodities. Projected US wheat ending stocks for 2012/13 were raised 50mb as exports were reduced by the same amount. Global wheat supplies for 2012/13 were lowered by almost 2mt, but carry-out was increased by 1mt. Maize figures were relatively unchanged; soya production was 79mb higher than expected, increasing carry-out by 2.5mt.

US soya bean sales including commitments are almost 40% above last year compared to the USDA forecast of 7% below. So there is no sign of price rationing yet. So far this season, China has bought 15.7mt of US soya (against 13mt same time last year).

The phrase ’demand destruction’ is one the industry is starting to dread. The fact that raw material stocks are so low and supplies are so limited, that a reduction of livestock numbers is the only form of rationing that can take place.

Human food is a priority, and the biofuel boys BP, ExxonMobil and Royal Dutch Shell have invested literally $billions, so have deeper pockets than any chicken or pig farmer. So livestock farmers are expected to take the ‘hit’. Apparently BPEX is forecasting a 5% fall in EU pig meat production next year (mainly due to higher raw material costs) compared to 2011.

Oil crushing plants in Argentina are struggling because they cannot prise soya out of the farmer hands at these lower values. We also hear that lorries are hampered from reaching plants because of all the floods, which indicates that soya planting will be further delayed.

The weather is now improving in South America with drier conditions in Argentina which facilitated planting in non-waterlogged areas. However some gloomy analysts in Argentina are predicting lower yields on maize and soya; the USDA expects 28mt and 55mt respectively, but factoring the rain, hail and flooding may reduce the crops to 22mt and 50mt respectively.

Rain fell in the main soya growing areas of Brazil so planting should accelerate.

Over the past decade, Argentina’s GDP has grown between 5 and 12% each year, mainly due to the export of soya and cereals. However, the growth of agricultural production is causing the urban population to worry about the link between pesticide usage and a host of medical conditions.

The Network of Physicians of Drop-sprayed Towns, comprising 160 doctors is demanding a ban on aerial spraying of pesticides within 1km of residential areas. Their ‘Declaration of Caroy’ cites damning and overwhelming evidence of some 30 serious medical conditions including cancer and birth defects.

Paraquat, glyphosate, 2,4-dichloro-phenoxyacetic acid (aka 2,4-D, the component of Agent Orange), cypermethrin, endosulphan, chlorpyrifos and atrazine have been implicated. Pesticide use has increased from 35m litres in 1990 to 285m litres in 2009, largely due to the huge increase in GM soya. Dosage of applied glyphosate has also increased from 2 litres/ha in 1996 to 20 litres/ ha in 2010 allegedly due to increased herbicide resistance.

Wheat in Australia is grown in two regions, East and West, of the two; the west is the biggest wheat producer of which 80% is exported. The harvest has started, and will peak in two weeks’ time. An analyst believes Western Australia's grain harvest could fall to 8.5-9.3mt (15mt last year) due to dry growing conditions.

The Ukraine has allowed another 5.5mt of wheat to be exported, and put back the export ban to Dec 1st.