Chinese investors will play an influential role in the global beef market over the next decade, according to Rabobank's latest report.

China’s beef demand will grow an additional 2.2 million tonnes by 2025. Driven by the weak domestic production, but with strong demand, the beef sector will likely become the first agricultural sector where China has high integration with the rest of the world and Chinese investors are expected to play an influential role in the global beef market.

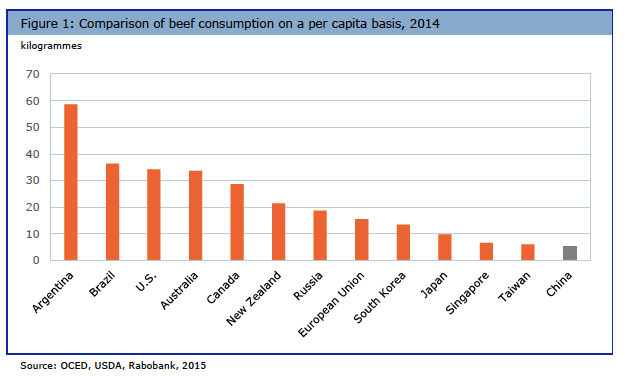

Beef is not a traditional meat in China, therefore it isn't surprising to see that beef consumption is under 6 kilogrammes per capita, far behind pork and poultry meat consumption. However, China's beef market has seen very impressive growth in terms of market volume.

The prices of beef have also increased and are now more than four times higher than in 2000, while pork prices have doubled, and poultry prices increased 1.8 times during the same period. Given the faster growth of beef consumption, this reflects consumers' higher tolerance for soaring beef prices versus other meats.

In addition to the volume gap, China’s beef market also demonstrates potential for value-added and branded beef products. Strong demand from the food service and retail market channels provides opportunities for both Chinese and foreign companies in the further processing sector.

“Beef companies face the challenge of where to source consistent beef supply, but they also need to develop, and even create, new markets by delivering new products and addressing the needs for convenience, tailor-made value-added products,” says Pan Chenjun, senior analyst from Rabobank.

To cope with the challenge, Chinese beef companies aim to participate in the whole supply chain--from farming to processing--in order to not only secure resources such as grassland, but also to take a strategic step to integrate the whole value chain. During the process, both big companies and medium-sized companies will be actively participating in cross-border investments.

With Australia remaining the top consideration, South America is becoming a new interesting area and US market still remains uncertain.