US winter wheat 'worst looking crop since 1986'

To quote Kim Hubbard (1868-1930): ‘Don't knock the weather. If it didn't change once in a while, nine out of ten people couldn't start a conversation’ - or write an article perhaps?

The (dry) weather in Brazil has improved slightly, as keen F1 fans will have noted last weekend; so 75% of the soya crop has been planted.

In Argentina about 40% of the soya has been planted, slightly lower than expected due to wet weather. In the UK those in the grain trade wishing their lives away until the new crop may have another shock coming because the omens are not good; either ‘not planted’, ‘eaten by slugs’ or ‘drowned’ seems to be the current state of play.

Perversely many farmers who scaled-up their drilling kit to plant faster now own machines too heavy to use on soggy land; older and lighter machines currently have the advantage.

Many UK maize farmers are still waiting to get onto the land to bring in their crop this year; needless to say that crop is not improving with the wait.

In the US the winter wheat is not looking good with the good/excellent rating near 33% (five year average 54%), the worst looking wheat crop since 1986.

Global stocks are tighter for both maize and wheat, with total grain ending stocks 2011/12 at 364mt almost identical to the previous year at 362mt. However the outlook for 2012/13 is 42mt lower at 321mt, and to make the figures balance the USDA is predicting a reduction of 41mt due to price rationing.

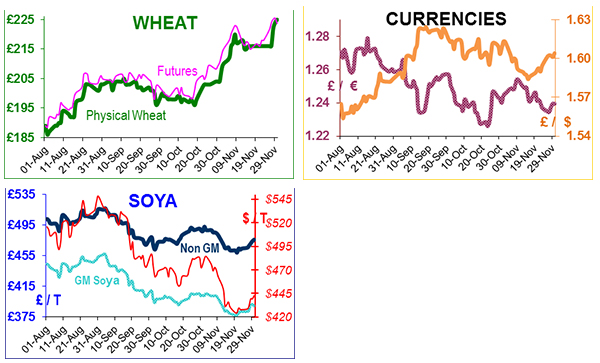

Crop estimates from Australia and Argentina are tending to be smaller, so it would appear that the world will depend on the US to keep them supplied with wheat in the pre-harvest months. UK wheat prices seem to be a little more volatile than either the US or French, and seem to ratchet up more quickly; possibly because of our unique situation – an island, semi-anti-EU, low bushel wheat, an over-dependence on imported EU milling wheat, currency, etc, etc. UK May wheat futures hit a record high of £230 this week, £15/t up in the last 30 days. Scary.

GM soya appears to have bottomed and is now £390 delivered to the mill. Non-GM is not available.

China appears to be easing the domestic (and global) tightness in soya by offering 800,000t/month from its reserves until early 2013, set to coincide with the South American soya harvests.

They are also being clever, offering it at relatively high prices (c£450/t) to tighten local supplies and reduce usage.

China has not approved the latest Brazilian GM soya (Intacta RR2), so the Brazilian soya association, Aprosoja, is begging its producers not to plant it, otherwise Brazilian exports to China (23mt) could be threatened as well as causing massive market distortion if China refuses to accept contaminated loads.

Monsanto says that it will incinerate 15,000t of the Intacta RR2 seeds to ensure compliance; however an extensive ‘test programme’ has already taken place and farmers had to indemnify Monsanto against cross-contamination issues. Never slow to seize an opportunity, the Chinese are offering low-interest loans to the Ukraine (standard local interest rate is 25%) in exchange for maize, soya, rape and sales of its crop technology.