Average farmland values in England & Wales reached record levels in 2011 and Chesterton Humberts forecasts that values will continue to increase by an average of 6% per annum over the next five years.

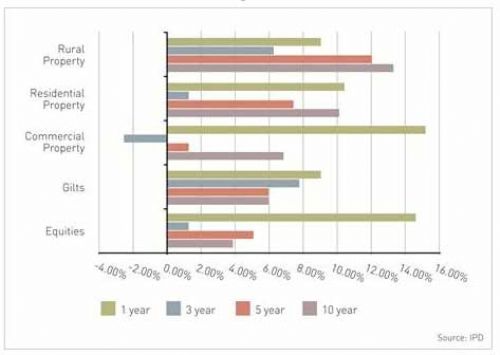

Growth in farmland values has outpaced equities since the early noughties and residential property since 2007.

Over a 5 and 10 year period, rural property total returns outperformed equities by 690 bps and 960 bps respectively.

UK agricultural income growth over the past decade was over three times higher than the EU27 average.

"The case for investing in the agricultural sector is becoming increasingly compelling." Through the post-global recession years, where there has been uncertainty surrounding other asset classes, agricultural land has continued to perform well.

Average farmland values in England & Wales have now almost quadrupled since 1995 and the RICS Rural Land Market Survey 2012 reported that they reached a record high in 2011 of ’20,722 per hectare.

Renewed interest from investors in the sector has been driven by the combination of a growing population, rising soft commodity prices and the drive to find sustainable alternative fuel sources placing growing pressure on the supply of agricultural land and in turn increasing farmland values. The low correlation between yields for farmland and those for other mainstream assets coupled with the tax planning incentives of owning land; relating principally to income tax, capital gains tax and inheritance tax, have enticed investors to add farmland to balance their portfolios.

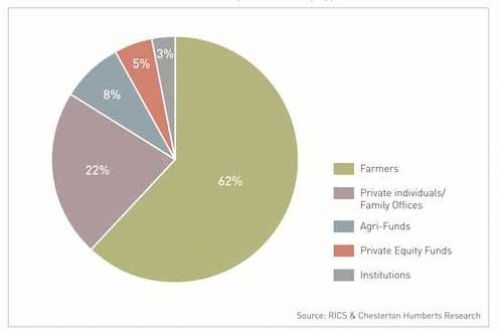

The industry now has a diverse range of investors, from wealthy individuals, private equity funds and institutions to specialist agri-funds although the majority of all farmland transactions, 62% of the total transactions during 2008 to 2011, are accounted for by farmers looking to expand existing operations and take advantage of high soft commodity prices.

David Hebditch, Head of the Rural Department of Chesterton Humberts comments, ’Over the past ten years the agricultural sector has seen a change in fortune. UK agribusinesses have flourished in a way they have never done before and farmland values have hit an all-time high.

He adds: ’Improved commodity prices and rental returns, with the strong rents generated by FBTs combined with the tax advantages and security of landownership, are important factors which are continuing to make land more attractive to non-farming investors in the current economic climate.

’The on-going debate over global food scarcity and our ability to meet the demands of the anticipated growth in world population is firmly back on the political agenda but it is also now being taken seriously by investors who appreciate that the supply of land will be paramount in resolving the food scarcity issue. With this in mind, we are predicting that farmland will increase further by an average 6% per annum over the next five years.

He adds: ’The risks of climate change are clearly visible this year with many parts of South-East England, East Anglia and the East Midlands experiencing drought. However this could also be seen as an opportunity for farmers to increase profits with longer growing seasons, reduced frost in the winter as well as creating potential new locations for crops.’