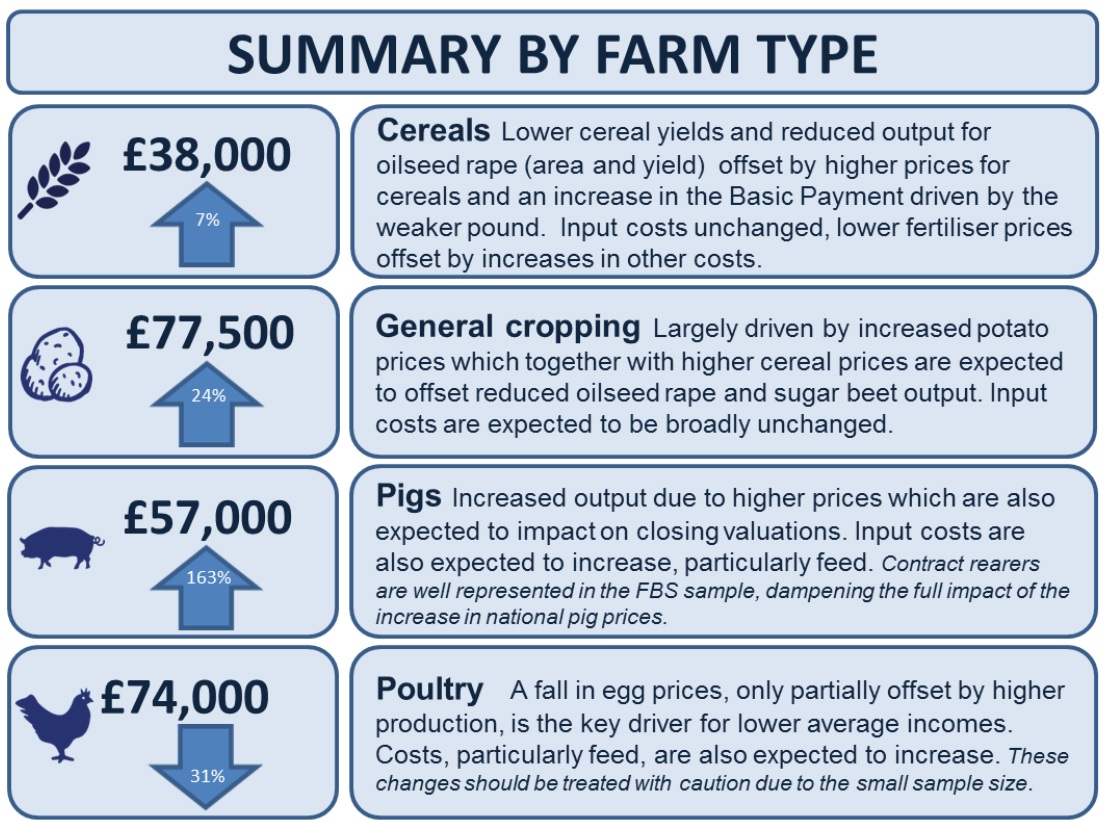

The fall in the value of the pound has been a key driver in increasing average Farm Business Income across farming sectors.

It has been a driver in increasing income in the cereal sector, general cropping, mixed, specialist pig, lowland grazing livestock and grazing livestock farms in the Less Favoured Area (LFA) for the year ended 28 February.

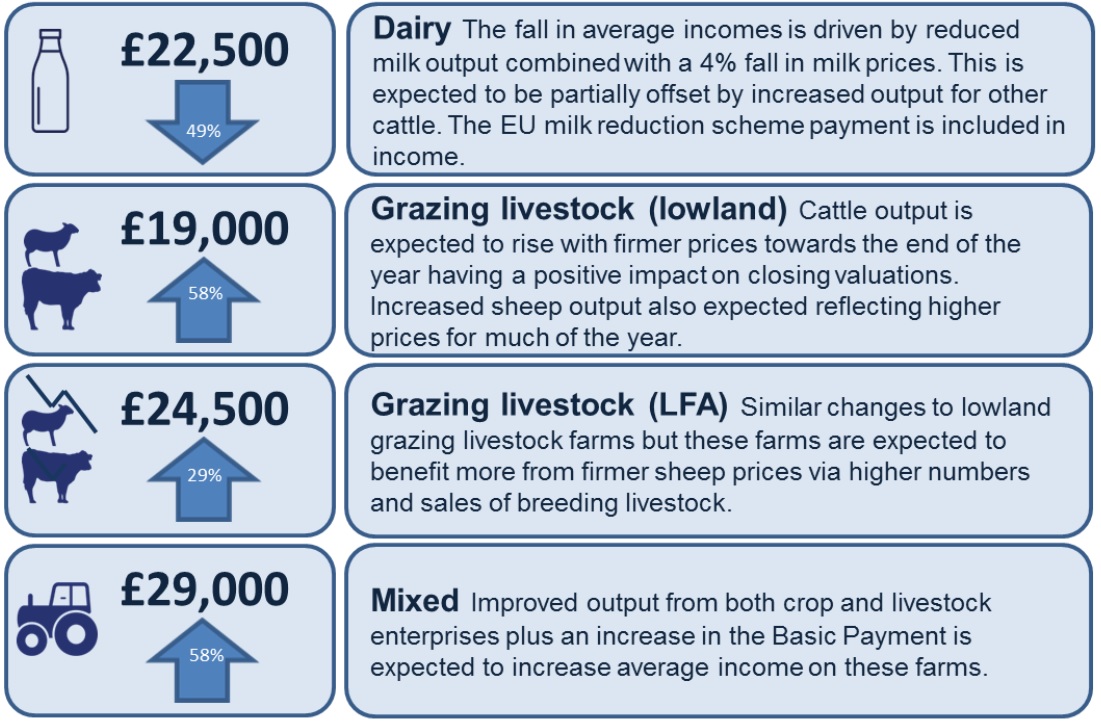

The statistics show that average incomes are expected to have fallen on dairy farms due to lower milk prices and reduced output.

Lower egg prices and higher feed costs are the main driver fora fall in average incomes on specialist poultry farms.

The 2016 Basic Payment is expected to be around 19 per cent higher than in 2015 for all farm types, reflecting the weaker exchange rate when payment rates in sterling we are determined at the end of September.

For non corporate businesses, Farm Business Income represents the financial return to all unpaid labour (farmers and spouses, non-principal partners and their spouses and family workers) and on all their capital invested in the farm business, including land and buildings.

In essence Farm Business Income is the same as Net Profit, which as a standard financial accounting measure of income is used widely within and outside agriculture.

Using the term Farm Business Income rather than Net Profit, gives an indication of the measure’s farm management accounting rather than financial accounting origins, accurately describes its composition and is intuitively recognisable to users as a measure of farm income.

'Unpredictable and volatile'

The National Farmers Union (NFU) said the figures suggest that farmers are still feeling the impact of an 'unpredictable and volatile' market place.

NFU President Meurig Raymond said that while many sectors had seen improved fortunes – mainly due to the falling value of the pound – the wider industry was suffering from sharp rises in farm inputs, such as for feed, fertilisers and machinery.

He said it is good news that many sectors are currently seeing improved commodity prices.

“However, for all sectors these figures can quickly change and steep reductions in the dairy and poultry sectors only go to emphasise that farmers are in an extremely volatile sector,” he added.

“Looking ahead, this uncertainty shows no sign of abating and there will be many challenges ahead as Brexit negotiations begin.

“With that in mind, I am calling on the government to ensure it can introduce a domestic agricultural policy which helps build a more profitable farming industry, by focusing on productivity, volatility mitigation and environmental measures, as highlighted at our conference last week.

“Our industry now needs certainty and firm commitments from government if the country is to feel the benefits of a thriving food and farming industry.

Mr Raymond concluded: “We have been clear on what we believe is needed to achieve this. Firstly unrestricted access to the European market, secondly continued access to a competent and reliable workforce both pre and post farm-gate and thirdly a new agricultural policy which assists in the development of an increasingly productive, progressive and above all profitable farming sector.”