Developers suffer from lack of funding as agricultural to residential property conversions fall

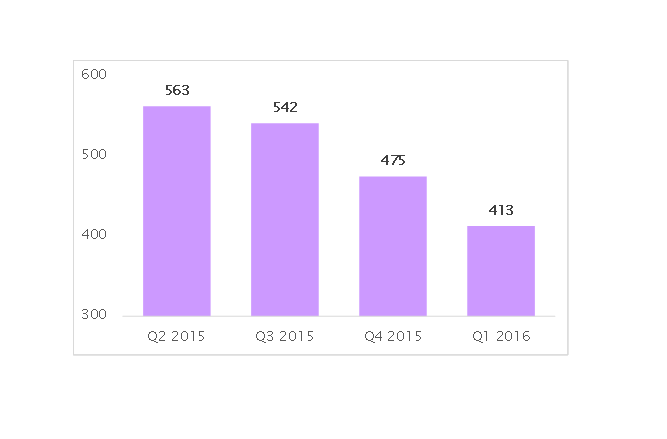

The number of agricultural to residential property conversions in England has dropped by 24% over the last year, from 563 in Q2 2015 to 413 in Q1 2016 as developers continue to 'suffer from a lack of funding'.

Saving Stream, the peer-to-peer property funding platform, says that there is considerable appetite amongst farmers concerned about EU subsidies after the recent Brexit vote to target alternative ways to diversify income.

The conversion of agricultural buildings, including barns and stables into residential property, has been one of the most popular options for farmers.

Saving Stream says that despite concerns about the potential effects of Brexit on the UK property market, agricultural-to-residential property conversions could still make significant financial sense for farmers.

It explains that the shortage of funding to the property sector is cutting off the supply of new housing that is vital to filling the UK’s housing gap which can be as acute in some parts of the countryside as in urban areas.

Banks are continuing to de-risk their balance sheets as much as possible, driven by the capital holding requirements placed on them by regulators in the wake of the credit crunch.

Private investors are stepping in to help finance projects as they are attracted to the competitive annual returns of 12% on offer for secured loans at a maximum loan to value ratio of 70%.

'UK’s chronic rural housing shortage'

Liam Brooke, Co-Founder of Saving Stream, explains: "Converting agricultural buildings such as barns are one of the most effective ways of combating the UK’s chronic rural housing shortage.

"In the uncertain post-Brexit climate, UK farmers are looking to ramp up activity in this area.

"It is important that access to funding is improved, developers are keen to take-up the large number of opportunities available to them but time and time again a lack of funding is holding them back.

Recent research shows that outstanding lending by UK banks to property developers plunged from £32.5bn in April 2014 to £14.9bn in April 2016 – a fall of 54%.

Liam Brooke adds: "There are housing shortages across the UK, in both urban and rural areas, and with increasing numbers of possible developments available, this is a perfect opportunity to reduce the housing gap.

"Private investors are helping bridge the funding gap that the UK’s property market has suffered from but there are still plenty of projects struggling to secure the finance needed to get off the ground.

"There is an eagerness from all sides to increase the number of conversions to help meet demand, however, the biggest issue remains access to funding."