Poland has been steadily increasing its presence on the UK pig meat market, which seems set to continue.

AHDB Marketing Intelligence looks to explore some of the factors behind this movement.

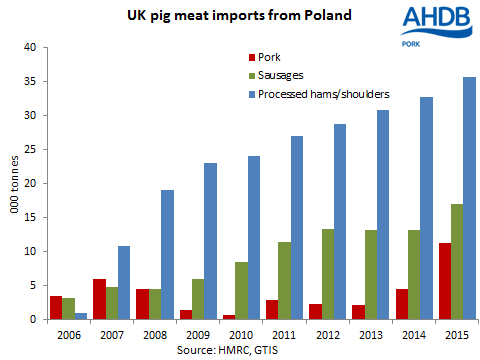

There has been a steady growth for processed products, notably canned hams, following Poland’s accession to the EU in 2004, while imports of fresh pork have started to take off.

Imports of processed hams and shoulders amounted to 36,000 tonnes in 2015 and since 2007, when it really started to develop, has more than trebled.

Sausages also account for a significant quantity of imports, 17,000 tonnes in 2015, although these have grown more slowly.

Such product is generally branded and sold not only through Polish retail outlets but increasingly through mainstream outlets.

For example, the ASDA website includes “Authentic Polish Foods”, with a wide range of processed pig meat products.

Other multiples also sell a range of Polish processed meats. The number of UK residents born in Poland now amounts to 850,000, although the true figure for the Polish population will be higher, as families will have children born in the UK.

Therefore, this accounts for a growing market for those customers seeking indigenous foodstuffs from the country in which they were born.

UK imports of Polish pork more than doubled

UK imports of fresh/frozen Polish pork more than doubled, to reach 11,300 tonnes, in 2015. As recently as 2010, imports only amounted to 750 tonnes.

This pork is destined for secondary processing and mainly consists of chilled boneless cuts and bellies.

However, one major Polish meat processor, ZM Wierzejki, which has 170 retail outlets in Poland, opened its first shop in East Acton,West London, at the end of last year.

Its press release indicates it has plans to open a dozen new stores and attract not just Polish consumers.

The meat-processing sector in Poland is sourcing its raw material from both domestic producers and imported product, some of which is subsequently re-exported.

Major investment is taking place, including by Scandinavian companies, some of which has yet to come on stream.

According to IFIP in France, much of this investment is geared towards supplying the UK market and the premium prices that it can offer.

This includes investment in cutting plants and further processing facilities. For domestic production, the Polish breeding herd has been in steady decline, as the sector is very fragmented and suffers from low productivity.

As many as 46% of sows were located on holdings with less than 100 sows in December 2013.

The most recent census recorded a decline in the breeding herd of 16%, with total pig numbers falling by 12%.

Poland increasingly importing from other EU countries

However, pig slaughterings and production have been more stable since 2010, as Poland has been importing increasing numbers of finishers from other Member States to support production levels, notably from Denmark, which accounted for 80% of total trade in 2015.

In 2006, only 168,000 weaners were imported by Poland but by 2015 official figures show a rise to 4.63 million.

In reality, the true figure may be in excess of this based on Danish export data.

Polish slaughtering companies have also been sourcing more imported slaughter pigs, which reached a peak of almost 1.1 million head in 2014, but which fell back by one half in 2015.

In the case of imported pork, in 2015 Poland received 128,000 tonnes from Denmark, of which almost 60% was fresh bone - in cuts for cutting up.

Of the 186,000 tonnes imported from Belgium, 90% was in fresh carcase form. As a result, Poland has been increasing both its imports and exports of fresh and frozen pork in recent years.

In 2015 imports amounted to 676,000 tonnes and exports 404,000 tonnes. The difference will be partly the result of the growing export trade in processed pig meat products, led by hams and shoulders.

While Poland is not yet a major player on the UK market (its market share of all pig meat imports is still only 7%), it certainly is on the EU market.

Even if its pig meat production is no longer expanding, its low labour rates and increased investment in processing is sucking in more imported product for subsequent re-export, including to the UK.

Volumes of processed products have been rising year-on-year, and increasing investment would suggest that this is set to continue.