The difficulties which pork has experienced at retail level continued in the 12 weeks ending 31 January, according to the latest Kantar Worldpanel data.

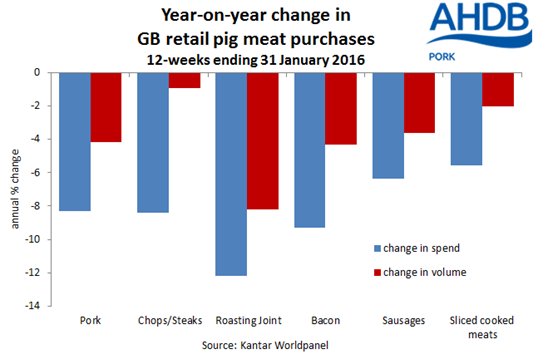

The volume of pork purchased continued to decline, falling 4% compared with a year earlier, with lower prices further driving value out of the market.

A decline in household penetration is the main driver of volume declines, as switching to convenience categories continues to play a major role. Loin roasting joints and marinades were the only two categories to buck this trend.

More encouragingly, the latest four weeks did see a small increase in volume sales of fresh/frozen pork.

There was growth across several categories, including belly, chops/steaks and leg roasting joints, although the trend of lower average prices meant that this was at the expense of value.

Sales of bacon, sausages and ham remained down, despite lower prices, on the back of a combination of fewer households purchasing and those that did, buying less.

During the 12 weeks to 31 January, the amounts of bacon and sausages purchased were both down 4%, despite prices falling by 5% and 3% respectively.

As with pork, sales of sausages did pick up in the latest four weeks, although the value of purchases was still lower due to reduced prices.

Irish pork exports may now slow down

Having grown for seven consecutive years, Irish pork exports reached 168,000 tonnes in 2015, 13% higher than the year before and more than double their level in 2009.

Around a third of this total headed for the UK market and Ireland also exports significant quantities of processed pig meat products to the UK (38,000 tonnes last year, including 9,000 tonnes of sausages).

Pork shipments to the UK only grew at a similar rate to those to other destinations in 2015, despite the favourable exchange rate, probably an indication of UK buyers’ continuing preference for domestic product.

Trade with Germany, mainly made up of sow carcases as in the UK, was up sharply, partly reflecting an 8% rise in sow slaughterings.

Third country trade was only slightly higher, as strong sales to China were offset by reduced exports to Japan, Korea and, of course, Russia.