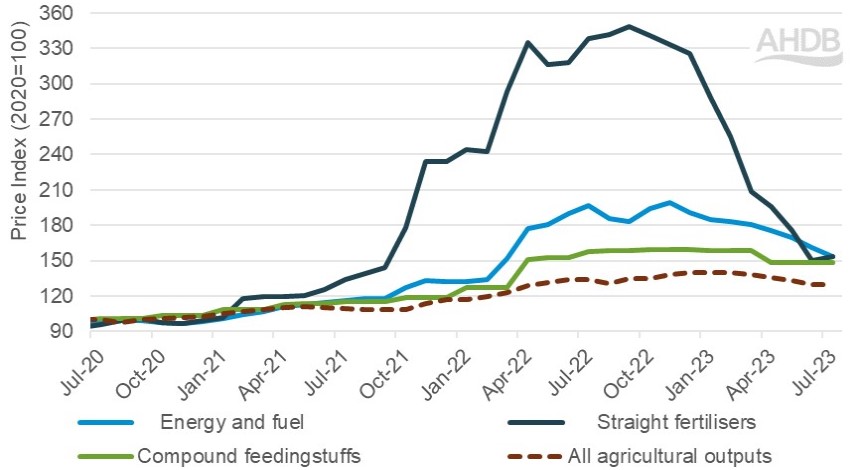

The latest agricultural price index (API) shows that the rate of inflation in prices paid for goods and services has continued to ease, but volatility remains.

Fertiliser price inflation has seen the largest decline, falling 53% in the first seven months of the year and down 56% compared to the inflationary peak in September 2022.

However, between June and July, there was a slight uptick in fertiliser price inflation. In August, GB fertiliser prices rose with UK produced AN up £17/t compared to the previous month.

Inflation for compound feeds has seen more marginal downwards movement, down just 7% from the peak in October last year.

Although the figures will largely be welcomed by farmers, AHDB said that pressure on margins remains as price inflation continues to sit at elevated levels, with key inputs maintaining a higher rate of inflation than outputs.

Freya Shuttleworth, AHDB analyst said: "We anticipate some volatility to continue in fertiliser price inflation as market pricing closely follows the movements in the natural gas markets."

Energy and fuel price inflation has eased at a more gradual rate than fertilisers, down 20% from the start of the year and a 23% drop compared to November 2022 where inflation peaked.

However, Ms Shuttleworth said farmers should expect to see some energy volatility over the coming months as winter nears and the cooler weather increases demand.

"Added to this seasonal demand growth is the current pressure on oil markets and prices, which energy and fuel closely follow," she said.

In September, UK fuel prices increased again with red diesel prices increasing 8% month on month, according to the latest API.

Wheat futures markets are currently at a similar price point to the beginning of last year, before the Russian invasion of Ukraine.

Ms Shuttleworth said that Southern Hemisphere crops were currently in focus both for short and long-term price direction.

"However, competitive Black Sea supplies continue to cap gains and are expected to fulfil global demand," she explained.

"Ample US, EU and South American maize supplies are also expected to weigh on grain markets moving forward."