British milk production could plummet by over half a billion litres as the Ukraine war severely impacts key inputs and feed ingredients.

According to new analysis by the AHDB, milk production could fall by up 605 million litres over the 2022-2023 season, representing a 5.3% decrease.

The war in Ukraine has led to uncertainty over how prices and the availability of key inputs will develop through the year, as well as the impact on cash flows.

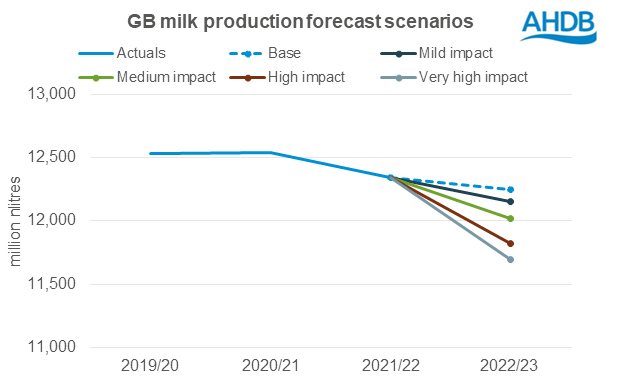

AHDB has looked at five scenarios showing that milk production could fall between 0.8% and 5.3%, depending on how changes impact decisions on farm.

In March, it published a baseline forecast based on discussions from the Milk Forecasting Forum, which set production for 2022/23 at 12,250 million litres, an 0.8% fall on the previous season.

The levy organisation has updated this forecast to reflect a range of scenarios from mild to very high impact based on changes to feed, cull cow and farmgate prices as well as retention rates.

Patty Clayton, AHDB lead dairy analyst said: “Access to key agricultural inputs and feed ingredients have been severely affected by the war in Ukraine, which is forcing decisions to limit production.

“The current uncertainty makes forecasting milk production for the upcoming season an even trickier task than normal, but we know it’s going to be a tough year for farmers."

She said reviewing input costs, feed strategies and making the most of home-grown forage can all help producers during this uncertain time.

"Farmers could also use the cost benefit calculator on our website to understand whether it makes sense to apply fertiliser to grassland."

What are the five scenarios?

AHDB has looked at the potential impact on milk production as part of five potential scenarios:

Low impact

• Assumes feed costs remain high into the autumn, but milk prices increase sufficiently to cover costs. Good grass growth in the spring provides a good volume of winter silage

• Yield growth remains at 0% for the year as per baseline forecast

• High cull cow prices, plus uncertainty over cashflows in winter arising from a reduced SFP and higher feed costs accelerates destocking. This is accounted for by a reduction in retention rates by 1% from the long-term trend

Medium impact

• Assumes feed costs remain high into the autumn plus higher volume of purchased feed due to lack of silage

• Could also cover situation where there is sufficient winter silage but increases in milk prices are not large enough to cover increased costs leading to a low MFPR

• Either of these situations are assumed to lead to negative yields growth of -1% for the year

• High cull cow prices, plus uncertainty over cashflows in winter arising from a reduced SFP and higher feed costs accelerates destocking. This is accounted for by a reduction in retention rates by 1% from the long-term trend

High impact

• Assumes further increases in feed costs through the year, driven by poor yields in key exporting regions as a result of reduced fertiliser use. In addition, there is a lack of good quality or sufficient volumes of silage for winter feed, leading to increased purchases

• The added pressure to cash flows provides a stronger incentive to destock, so retention rates are reduced by 2% from the long-term trend

• Yield growth remains at -1% for the year

Very high impact

• In addition to the high feed costs and higher purchases (due to lack of good quality or sufficient volumes of silage), milk prices fail to keep up with rising input costs. Yields fall by 2% for the year due to the low returns on purchased feed

• The high cost to retain animals over the winter, plus the incentive to sell for cashflow reasons

• Retention rates lowered by 2% from long term trend due to high cost to keep animals over the winter plus incentive to sell to ease cashflow