NFU Cymru has written directly to the prime minister calling for a u-turn to the controversial changes to inheritance tax rules, as they are causing 'distress and torment' among farmers.

The letter comes as the government is expected to publish draft tax clauses for the next Finance Bill, against the backdrop of rising concern across the rural community.

At the heart of the issue are reforms to agricultural property relief (APR) and business property relief (BPR), announced in the 2024 autumn budget, which are set to come into effect from April 2026.

Under the proposed changes, 100% inheritance tax relief for qualifying agricultural and business assets will be capped at £1 million.

Any value above that threshold will receive only 50% relief, with both APR and BPR contributions counted within the same £1 million limit.

The policy shift is being seen by many in the industry as a direct threat to the future of family farming in the UK.

The looming 'family farm tax' has prompted widespread anxiety, particularly among older farmers facing complex financial decisions with little time to prepare.

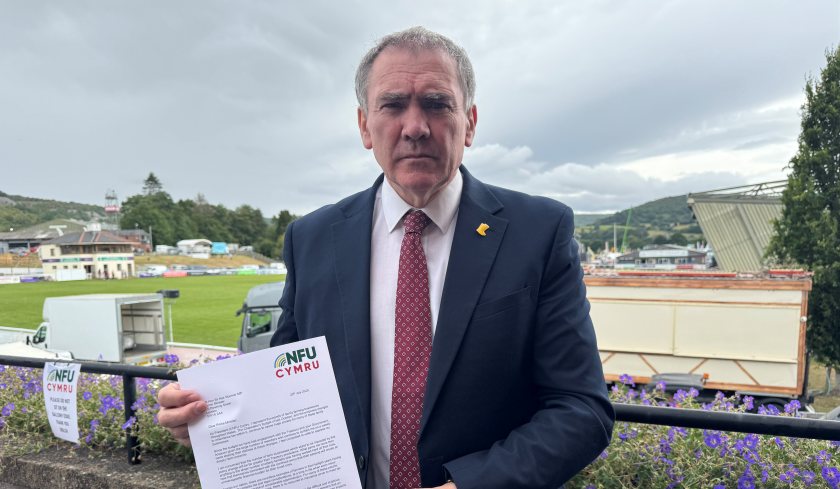

NFU Cymru President Aled Jones said he had no choice but to write to Sir Keir Starmer after receiving an outpouring of concern from farming families across Wales.

“I have been compelled to write to the prime minister after being contacted by hundreds of concerned Welsh farming families,” he said.

Mr Jones warned that the number of farms likely to be affected by the inheritance tax changes could far exceed the Treasury’s estimates.

"What pains me more than anything is the sheer number of elderly farmers who, having worked hard all their lives, now find themselves tormented with the continual worry that their passing will create an unmanageable financial burden for their loved ones."

He highlighted how older farmers—many in poor health—are now having to grapple with complicated tax and legal issues, often without access to insurance that could help meet future tax bills.

“Across our nation, there are countless examples of farmers in their twilight years having to deal with complex tax and legal considerations, at a time in life when even minor decisions can be a source of considerable apprehension,” he said.

“For many of these people, either due to age or health issues, there is no recourse to insurance cover to meet tax liabilities.”

Mr Jones said it was unthinkable that any government would deliberately place elderly farmers in such a “difficult and invidious position,” and urged ministers to reconsider.

“My view remains that an opportunity still exists for your government to mitigate very many of the human impacts of these policy proposals, whilst meeting the government’s aim of raising revenue.”

The fallout is made more contentious by what many farmers see as a broken political promise. In November 2023, at the CLA Conference, then-Shadow Defra Secretary Steve Reed MP — now Defra Secretary — declared: “We have no intention of changing APR.” That commitment, farmers say, has now been abandoned.

NFU Cymru’s letter is part of a wider campaign to #StopTheFamilyFarmTax, which urges farmers to write letters to their local MPs explaining the personal and financial impact of the reforms.