Picture: Gross margins are based on yields calculated using the HGCA

Cereal growers should not be fooled into thinking that the current increase in grain prices is here to stay. A survey of leading grain traders shows that whilst growers will benefit from higher prices this autumn, come this time next year it is projected (see footnote) that the feed wheat grain price will have dropped back 14% to around £74/tonne, whilst the price for full specification Group 2 wheat will only fall back 5%.

Bearing this in mind, the message to growers is that whilst there is a market for Group 3's it is important that the oversupply of soft wheats does not continue. With a further trade survey showing that growers have yet to decide what variety to grow on around 30% of their winter wheat area, they should take the opportunity grow a more balanced portfolio of wheats and take advantage of the demand there is for Group 2s and the resultant premiums available. In doing this they need to take into account the projected ex-farm feed wheat price for autumn 2004 which shows what demand there is for Group 2s and not base their decision on this year's 'on-off' rise.

"The consistent message during this spring was that growers should not commit themselves so heavily to Group 3 varieties, but take advantage of the newer Group 2 varieties with their proven quality that suits both home and export markets, and the wider export markets open to these varieties," states Bram van der Have of Advanta Seeds UK. "Nothing has changed. The message from the trade is that prices will fall back next autumn and so growers must look at what price benefit the increased premium from Group 2 varieties will provide in a lower price grain market."

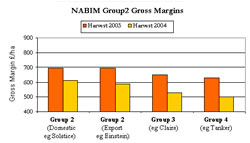

The impact that this change in grain price will have on returns can be seen in the gross margin analysis below, which compares current leading Group 2 varieties with the leading Group 3 and Group 4 varieties. As can be seen the impact that the demand for Group 2 and the subsequent premiums available is considerable, with the margin for Group 2's for domestic use dropping by only £82/ha to £615 whilst the Group 3 and 4's drop by £123 and £127 respectively. It addition it should be remembered that fixed costs such as power and labour are not dropping and need to be covered.

Footnote

This year an exceptional set of circumstances has resulted in the current grain price rise, but looking ahead factors such as the quality of the 2004 crop; planting levels in the EU and central and eastern Europe; the value of Sterling to the Euro; winter damage; the influence of the southern hemisphere and North American plantings will all affect World market levels, which ultimately dictates what the UK farmer is paid.