We are in a weather market which has turned nasty over the weekend, and with 57 wild fires reported in the USA on 1st July, of which 49 were ‘large, uncontained’.

Most of the fires are in the Western states and the Mid-West is still suffering from very hot weather. This is one of those occasions where a ‘cry wolf’ weather market turns round to bite you.

The fires are reminiscent of the TV reports from Moscow just before Russia announced its wheat embargo. Although there is a ‘only’ a 50% chance of El Nino this year, it seems that we have had unusual weather in the USA, and even some extreme weather events here in the UK - the Met Office recorded more than 110,000 lightning bolt strikes last Thursday.

To misquote Aristotle, ‘One storm does not an El Nino make’ [One swallow does not a summer make], but that does not stop El Nino Mystic Megs searching for diagnostic symptoms in Australia and South America. Rain is expected to sprinkle Black Sea spring wheat this week but the outlook is dry.

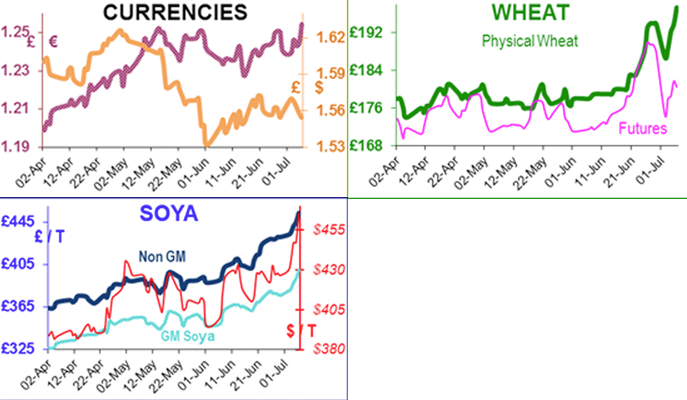

Rumours have been circulating that the Ukraine may limit its exports this year, but their Prime Minister denied any such plans. Ukraine exported 21.8mt of grain in the 2011/12 marketing year, of which 14mt was maize and 5mt wheat. Russia exported 27.8mt of grain over the same period, of which 21mt was wheat. The big question is how much will they export this year? Probably less due to … the weather! All of which means that the EU exporters will be busy, which could well drag up UK prices. UK wheat is currently £205/t delivered to the mill for July, £210 for first half August, and new crop £178 on the same basis. A week ago, prices were about £15/t less!

The IGC lowered its estimate for global wheat production in 2012-13, by 6mt to 665mt (30mt less than last year) due to inclement weather, particularly in Russia; but global consumption is 682mt, so the world will be short of wheat. Global maize production was increased by 4mt to a world record 917mt, due to better harvests in China and India; but world consumption is put at 910mt – which leaves little wriggle-room. The US is currently expected to produce 350mt, but the final figures will depend on the weather.

A USDA report is highly anticipated next week, where the USDA is expected to downgrade US maize yields from its current 166b/acre (147.2 last year) to below 150. It is hoped (by livestock not arable farmers) that here in the UK, there might be a higher proportion of feed to milling wheat than usual due to the recent inclement weather which continues to reduce the quality of the milling wheat crop.

July soya beans hit a high this week of $16.44/b - a smidgeon shy of their all-time high ($16.63) which occurred on 3rd July 2008 when crude oil hit its all-time high of $147/b, just two and a half months before Lehman went bust. Soya yields are also being revised downwards from the USDA’s current 43.9b/acre to a trade estimate of 41b/acre.

Keen to lock in these high prices, it is reported that Brazilian soya farmers have sold 30% of next year’s crop, even though it will not be in the ground for another 2 months!

There are rumours that the high maize prices (about $7/b) are forcing bioethanol plants to close, and that US gov may cut the 20% bioethanol inclusion mandate into petrol; to allow more maize (1bb) to be available for food/feed. In theory this would take some price pressure off maize and force it onto soya (less DDGS).