Export issues ahead as Russia invades Ukraine, AHDB says

Several agri-exports from Russia and Ukraine are set to face significant disruption following new military action in the region, new AHDB analysis shows.

In particular, wheat, maize and sunflower oil exports from Russia and Ukraine will face challenges, according to Helen Plant, AHDB's senior analyst.

The region is one of the world’s largest producers of wheat and numerous vegetable oils.

Interfax, a Russian media source, reported earlier this week that commercial ship movements in the Sea of Azov are suspended.

Russia controls the Kerch Strait, where the Sea of Azov joins the Black Sea. Both countries export from the Sea of Azov, though most exports are from the Black Sea.

In addition, Ukraine has asked Turkey to prevent Russian ships leaving the Black Sea.

Turkey controls the Bosphorus and Dardanelles straits but, as of Sunday 27 February, has yet to respond to Ukraine’s request.

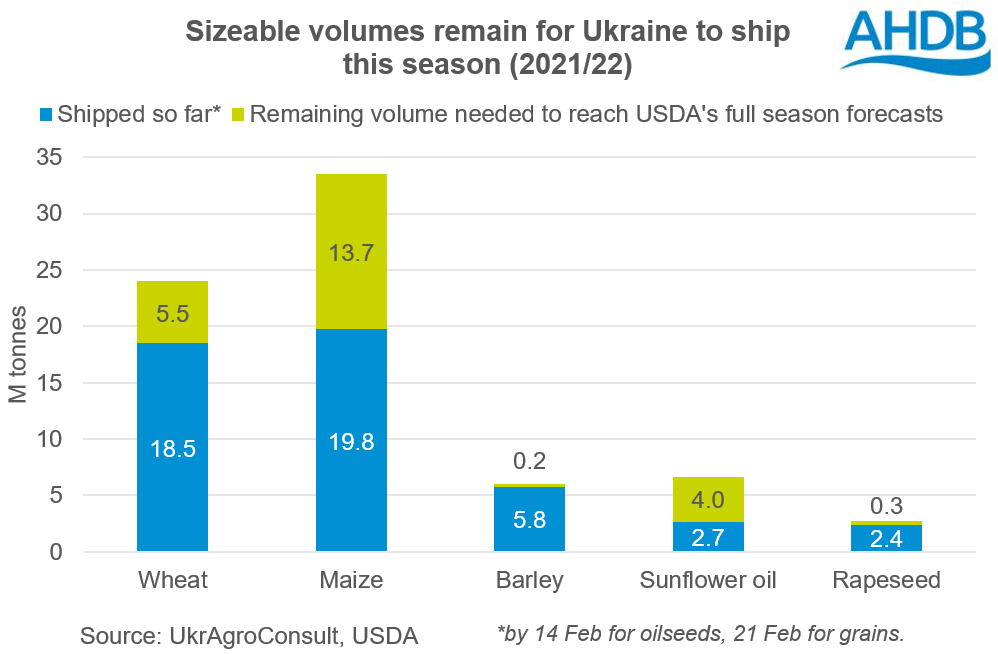

"We’re still likely to see disruptions to exports from the region and there are significant volumes of wheat, maize and sunflower oil left to ship this season," Ms Plant says.

"Given the importance of Russia and Ukraine to global grain exports and sunflower oil exports, prices for these commodities are rising rapidly."

Stocks in other major exporters are already expected to fall to low levels by the end of this season, the analysis shows.

This amplifies the global price impact, she explains, and thus the impact on values in the United Kingdom.

For grains, disruption in exports from Russia and/or Ukraine is likely to push more demand to other major exporters.

For wheat, this could be the EU-27 or US. The options for maize are less clear given the issues with South American crops of late.

However, for sunflower oil, she explains that Russia and Ukraine were expected to account for 78% of global exports this season.

Disruption could mean a need to switch to other vegetable oils, her analysis says. In turn, this would lead to support for rapeseed oil as well as rapeseed prices.

"The escalation may also have impacts beyond the global grain and oilseed trade and prices this season," Ms Plant says.

"It could also increase costs for UK farmers for the 2022 crops, through fuel and fertiliser prices."